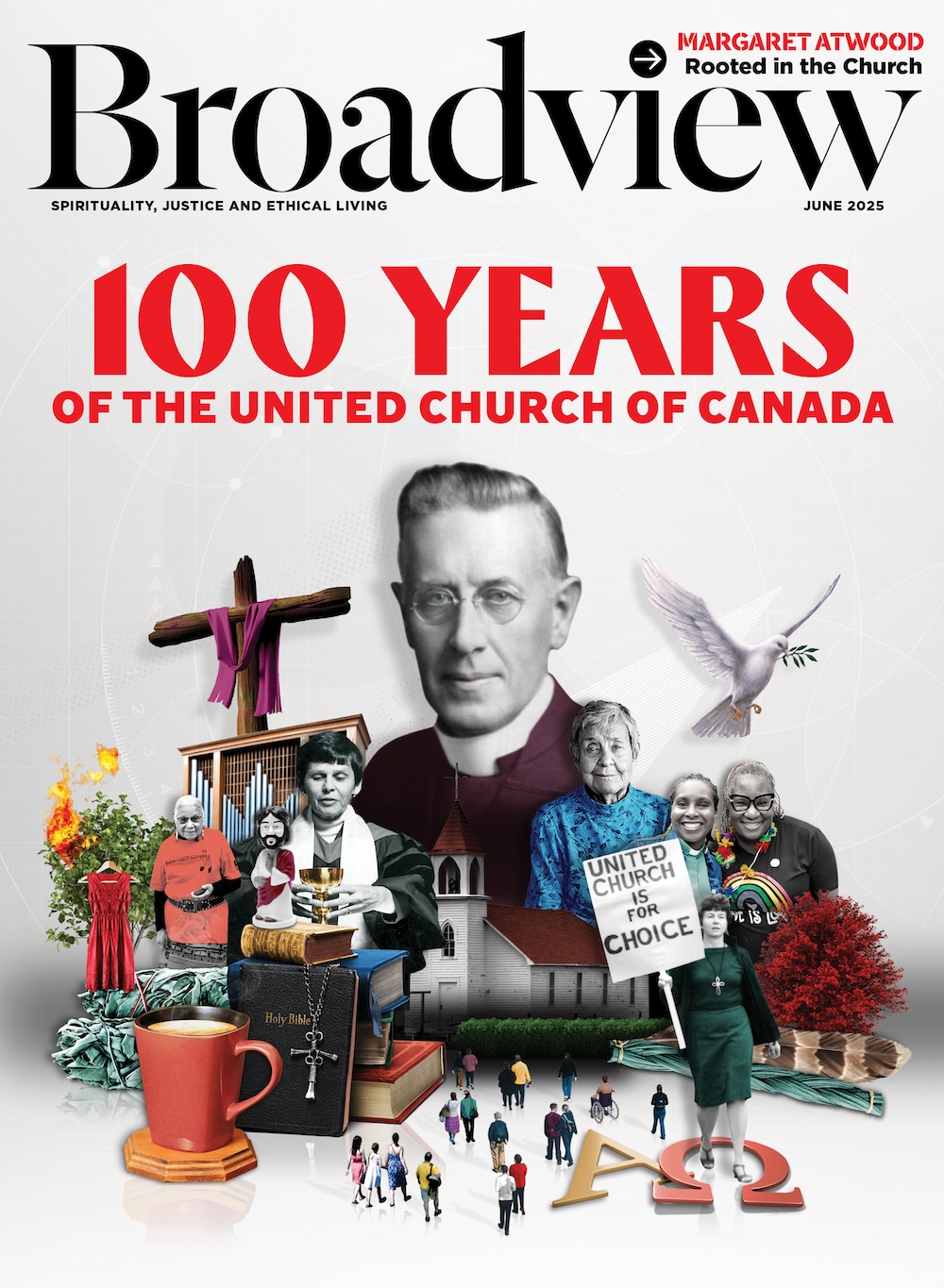

When the Vancouver Foundation phoned Rev. Doug Goodwin last spring to set up a meeting, he suspected it would bring good news. As executive secretary of British Columbia Conference, Goodwin already managed income from several endowments held in the $735-million community foundation — Canada’s largest. But he wasn’t prepared for how good the news turned out to be.

Officials from the Vancouver Foundation told Goodwin the Conference had been tagged to receive the income from $17.5 million — half of the William E. Jardine Memorial Fund. Judith E. Jardine, a Vancouver woman with longtime family connections to the city’s Ryerson United Church, created the fund, named for her father. She died in 2006 at the age of 81. The bequest will yield the Conference about $700,000 a year in a stream of payments that will continue indefinitely.

As well as putting B.C. Conference on a secure and sustainable financial footing, Jardine’s gift shines a spotlight on a heightened General Council emphasis on using bequests and endowments to fund church work.

Even before it received word of the Jardine bequest, B.C. Conference had about $30 million from bequests and property sales and was showing how investment income can ease present and future budget concerns. The windfall merely accelerates a 10-year plan to use investment income to fund staff work, camping, and new and revitalized ministry projects.

The Executive of B.C. Conference moved quickly to share its new income, giving back $185,000 of its yearly grant from General Council. The bulk of the annual endowment income, $350,000, will be spent on elements of the 10-year plan — already in place — to develop church leaders. The rest will be used to top up recent funding cuts to campus ministry, pay for coming changes in ministry personnel oversight and fund various small projects.

“What this enabled us to do is some of the stuff we’ve dreamt about, encouraging new ministries and new opportunities,” says Conference president Rev. Jenny Carter. “It’s an incredible opportunity. The church is not in the business of being rich; the church is in the business of fostering life.”

Aside from Judith Jardine’s family history of supporting and attending the United Church, her reasons for selecting it as a major beneficiary were not stated. But for Carter, Jardine’s choice points to the value of long-term support for ministry. “Clearly the church has meant something to her,” Carter says. “And to me, that is why we are around, to make a difference in people’s lives.”

While Judith Jardine entrusted her money to the Vancouver Foundation — a secular foundation that funds hundreds of innovative community projects — senior United Church fundraisers hope more members will consider the opportunities in their own church community.

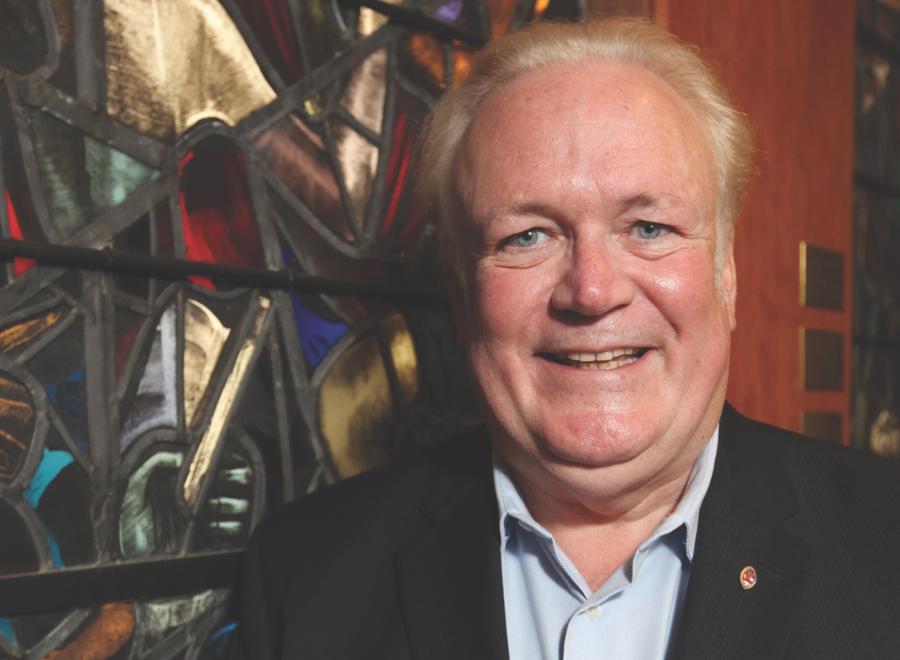

David Armour, president of the United Church of Canada Foundation, calls the organization one of the church’s “best-kept secrets.” That may soon change. Last summer, the foundation got an instant boost when General Council transferred about 400 endowments worth about $30 million to its holdings. With about $4 million in assets two years ago and $13 million at the end of 2012, the foundation now oversees funds and endowments worth about $43 million. In the world of foundations and endowments, bigger is always better: larger funds get access to more secure, productive investments; they attract more and wealthier donors; and they can fund more work without eroding capital.

Endowment funds lodged within the United Church of Canada Foundation allow donors to make bequests of any amount to finance various areas of church work, from housing for seniors to programs for children living in poverty and scholarships for aspiring ministers. Donors decide where the money is spent and can name specific congregations, programs or ministries, if they wish. A grants committee makes sure that the income from most endowments is shared with appropriate groups and projects, in line with the original donors’ wishes.

Along with the individual endowments, the foundation has also created generic endowment funds that generate income for the Mission and Service Fund, peace and justice endeavours, new ministries, leadership and theological education.

Working with Fiera Capital Inc., one of the United Church Pension Fund’s investment managers, the foundation earned a 9.17 percent return last year. In addition to managing endowments, the foundation has a co-investment program that lets United Church congregations (many managing endowments and investment funds of their own) invest in Fiera’s balanced funds. So far, 80 congregations have invested $18 million this way.

With the various services it offers, says Armour — also head of General Council’s philanthropy unit — the foundation is “really about creating custom solutions for what organizations need.”

Relations between the church and the foundation are governed by a written agreement, and General Council does not have free access to foundation funds.

The United Church of Canada Foundation is still a long way from matching heavyweights like the Vancouver Foundation. But economists and financial planners say Canada is in the midst of a trillion-dollar intergenerational transfer of assets from the parents of the baby boom generation to their children.

Peter Harder, an Ottawa-based lawyer and the current chair of the church foundation’s board, says, “We can be part of that [transfer] and provide opportunity for our members and adherents and those who are interested in the well-being of the church generally to contribute in new and deliberate ways.”

Baby boomers are not well represented in United Church congregations, but their parents’ money may help keep the church alive for generations. Doug Flanders, the General Council’s director of major and planned gifts, says the United Church has received about $250 million in bequests over the past 15 years. Most of this went to congregations. Many bequests, such as Judith Jardine’s, are unexpected. But about 1,900 people have let Flanders’s department know they remembered The United Church of Canada or its congregations or ministries in their will.

“Older donors tend to have a greater trust in the church,” Flanders says, and often give undesignated bequests that the church can spend or hold. But, he adds, “many of our donors and particularly a younger element . . . want to have more hands-on involvement.” This usually means setting up an endowment or contributing to an existing fund that will produce long-term income.

“The church is not going to disappear,” says Flanders. “It’s morphing into something else, and bequest gifts can provide so much opportunity for the next generation.”

Armour agrees that legacy giving is all about the long view. “The results often don’t come in for 30 years,” he observes. The example of B.C. Conference’s recent windfall is a prime example of how decisions made today can bear fruit down the road.

Armour says the bequest probably reflects “really good work done decades ago.” Thanks to that work, the Conference finds itself on a stable financial footing now and for the foreseeable future.

Aside from the United Church of Canada Foundation, large endowment and investment funds are already in place and at work across the church. Individual congregations hold the largest pool of investments and endowments, adding up to $487 million, mainly from bequests. More than a quarter of this is held by 78 congregations with more than $1 million apiece.

Among other funds:

Toronto Conference

The recently created Presbyteries of Toronto Conference Corporation has about $12.5 million, mainly from church property sales; it distributed $471,435 in grants for a variety of church projects this year.

Toronto United Church Council also manages funds and endowments worth $6.8 million, primarily gifts from individuals or families. Most of this is invested to generate long-term income that funds camping, affordable housing and other church development projects. As well, $9.2 million in the council’s Investing in Ministry Fund provides investment income for congregations who provide the funds, and low-cost loans for congregations who borrow from it for church capital projects.

Montreal Presbytery

The Presbytery’s long-standing Finance and Extension Board has a fund of about $10 million, mainly from church property sales, that distributes income annually for congregational programs and projects. Last year, $7.15 million from the sale of the Griffith-McConnell home for seniors in Montreal wound up in the United Church of Canada Foundation. Of that total, $4.9 million went to a new Montreal Fund for Seniors’ Ministry (with grants directed by a Montreal Presbytery committee), and $1.125 million each to the foundation’s Mission and Service Fund and New Ministries Fund endowments.

Morrison Bequest

The $20.7 million Morrison bequest, received by the United Church’s General Council in 2000, was the proceeds from a trust established by Richard Lindsay Morrison, a physician, businessman, lay preacher and devout Methodist, who died in 1954. The fund has produced income of about $15 million, but General Council spending reduced it to $9 million by the end of last year. The bequest is now considered part of the $19.1 million in church reserve funds available for special projects or paying off budget deficits.

General Council reserves

After trusts and endowments were transferred to the United Church of Canada Foundation, General Council still has about $60 million generating income in reserve funds. Most is earmarked for meetings, insurance, loans to congregations, property maintenance and balancing returns on long-term investments.

***

This story first appeared in The United Church Observer’s October 2013 issue with the title “The church’s ‘best kept secret.’”