Lisa Matthaus has spent most of her adult life fighting for the planet. For more than two decades, she has worked for environmental non-profits, campaigning tirelessly to protect forests and water, and lobbying for British Columbia’s groundbreaking carbon tax. In the mid-2000s, she was part of the group that helped negotiate the Great Bear Rainforest conservation agreement.

But Matthaus had one blind spot when it came to living her environmental values: her investment portfolio. She’s no rookie investor — she has an undergrad degree in finance (along with a master’s in environmental and resource economics) and spent seven years working as an investment banking credit analyst. Nonetheless, she’d been funnelling her retirement savings into plain old mutual funds, which meant her money was almost certainly being pooled into oil companies and other big polluters. “Aligning my investments with my values was always something I wanted to do,” says Matthaus, “but I couldn’t see how to do that.”

Then she heard about Tim Nash, an investing coach whose sole focus is helping clients do just that. She and Nash created a new portfolio, only including companies that fit her environmental ethos. “My value priorities are avoiding fossil fuel companies and the classic weapons and tobacco companies, as well as supporting renewable energy and other clean technology companies,” says Matthaus.

Today, her money sits in a range of exchange-traded funds (pooled investments that trade on the stock exchange) that no longer prick her conscience.

More on Broadview:

How charity is changing in Canada

3 things fundraisers wish donors knew

Why Broadview has changed how it invests its money

Matthaus is one tiny part of the growing “divestment” movement. From the Rockefeller family (which made its fortune in oil) to the City of New York, 1,000-odd pension funds, insurance companies, municipalities, universities, churches and others have committed to divest from the fossil fuel industry so far, withdrawing more than US$9 trillion in assets. Norway’s US$1-trillion sovereign wealth fund — created to invest the nation’s profits from North Sea oil — is divesting from oil exploration companies, but will continue to invest in BP, Shell and other players that have renewable energy operations. A year ago, Ireland’s parliament voted to sell off its investments in oil and coal, becoming the first country to do so. “Ireland, by divesting, is sending a clear message that the Irish public and the international community are ready to think and act beyond narrow, short-term vested interests,” the member of parliament who introduced the bill told the Guardian at the time.

The divestment movement isn’t limited to fossil fuels, of course. Loosely, it means selling off any investment deemed morally ambiguous or downright unethical. The University of Toronto led the way back in 2007, selling off tobacco holdings in response to a student-led petition. Today, students across the country are urging their campuses to divest from companies that do business with Israel.

As an individual investor, divesting might be one of the most meaningful ways to put your money where your mouth is when it comes to living by your social, political and environmental principles. But it can be harder than it sounds. Nearly 40 percent of Canadian financial wealth is parked in pooled investments like mutual funds, each of which can contain hundreds of individual stocks, bonds or other investments. So unless you’ve spent hours painstakingly poring over the documents for each of the funds you hold, chances are you have no idea what’s actually in your portfolio and could be unwittingly supporting industries you’d prefer not to.

For instance, just about any general Canadian mutual fund will include oil and gas, mining and defence stocks, along with a smattering of alcohol, tobacco and gambling ones. These are typically referred to as “sin stocks.” A global fund might include Swiss conglomerate Nestlé or the German multinational Bayer, owner of controversial agricultural company Monsanto.

Not surprisingly, ethical investing, the flip side of the divestment movement, is growing, too.

Nash, whose Toronto-based firm, Good Investing, teaches Canadians how to invest more intentionally, has dealt with plenty of shocked investors looking to divest. “Clients have a very visceral reaction when they see the companies in their portfolio,” he says.

It doesn’t have to be this way — but if you want to invest responsibly, you have to make a conscious effort. “Investors need to understand that if they’re not investing in a socially responsible fund, then there’s a very, very, very good chance they’re investing in sin stocks,” says Nash, who also runs a blog under the name the Sustainable Economist.

Not surprisingly, ethical investing — the flip side of the divestment movement — is growing, too. According to the Responsible Investment Association, 77 percent of Canadian investors say they are interested in sustainable investing, and robo-adviser Wealthsimple says an estimated 30 percent of Canadian assets are invested in funds with a socially responsible mandate.

That’s not to say it’s simple to make the switch. “It can be a little intimidating,” says Nash. “But it’s the decision that will have the largest impact.” According to Canadian green-energy investment firm CoPower, the annual carbon footprint of an average $100,000 portfolio is larger than the combined impact of a round-trip flight, driving a car and eating meat — so re-arranging your finances can make a big difference.

Here’s how to get started:

Learn the lingo

Putting your money where your morals are is loosely referred to as socially responsible investing, or SRI. There’s no hard-and-fast definition of what constitutes SRI, since everyone’s social values are a bit different. But in general, it means supporting companies whose business practices align with themes around social justice, responsible corporate governance and environmental sustainability (also known as ESG, for environmental, social and corporate governance.) SRI funds typically, though not always, eschew investments in fossil fuel companies and instead focus on sectors such as banking, health care, environmental services and, of course, renewable energy. They might also put an emphasis on companies that adhere to responsible corporate governance practices — for instance, mining companies that abide by strict labour and human rights rules when working in developing countries.

Impact investing takes this a step further, putting money into companies that aim to solve social or environmental problems in addition to generating a financial return.

Decide what “social responsibility” means to you

Socially responsible investing will look different for everyone, so you need to start by asking what it means to you. Are you okay putting money into casino operators? Would you prefer to steer clear of mining and the oil sands? Is representation of women on corporate boards important to you?

Nash says it’s possible to tailor your portfolio so that you’re only putting money into companies you deem to be moral and responsible or create impact in a way that you value. He has a diverse roster of clients, from human rights lawyers to vegans — he even created an anarchist-friendly portfolio.

Know the numbers

Many investors — and even plenty of financial advisers — are scared away from socially responsible investing because they believe the returns will be far lower than a traditional portfolio. But Dustyn Lanz, chief executive officer of the Responsible Investment Association, says that’s a misconception. For instance, the MSCI World SRI Index, which tracks companies with high ESG in 23 countries, has posted an annualized return of almost six percent since 2007 — slightly higher than the broader, non-SRI index.

Request a detailed list of your investments

If you have one, ask your financial adviser for a full list of the companies in your portfolio. Be sure to look at all the holdings, rather than just the top 10. A quick scan might reveal names that contradict your personal values. This is referred to as “negative screening.”

A simpler option might be to start with an SRI portfolio and work your way down the list to remove companies that don’t align with your values. For instance, you might come across companies such as oil producer Suncor. “It’s the most ‘socially responsible’ of all the tar sand companies,” says Nash, which is why you’ll find it tucked inside some SRI funds. Other popular SRI options include tech companies like Alphabet and Facebook, which have been accused of covering up sexual misconduct and flagrant abuses of privacy, respectively.

Find the right financial adviser

If you don’t already have one, find an adviser who shares your perspective. Nash notes that some of them are still ill-informed about SRI. He has had clients come to him after being made to feel silly — or even brought to tears — by an adviser for wanting to shift their investments into an SRI portfolio.

If your adviser isn’t helpful, reach out to one who specializes in SRI — the Responsible Investment Association is a good place to start for a list of experts. You might also want to consider working with a fee-only adviser. They get paid only for providing unbiased investment advice rather than recommending specific investing products and taking regular commissions on your assets.

Decide what kind of investor you are

If you’re a novice investor with modest assets, your local bank, co-operative or financial management firm probably offers cookie-cutter SRI options. Or you can turn to a robo-adviser like Wealthsimple or WealthBar, which have SRI-focused funds.

But buyer beware: “Some funds do have companies that engage in activities people may not view as socially responsible,” says Wealthsimple’s Rachael Factor, adding that the company is limited by the relatively small number of SRI funds available. Wealthsimple’s SRI portfolio incorporates the iShares Jantzi Social Index ETF, for instance, which includes oil companies such as Suncor and Encana.

Your best bet might be to build your own SRI portfolio via a self-directed online brokerage account — though unless you’re a relatively sophisticated investor, you might want to consider hiring an SRI investing coach to help.

Nash’s Sustainable Economist blog also offers a few model do-it-yourself portfolios, including the Vanguard Cheap AF ESG Portfolio and the Organic Couch Potato Portfolio.

Think long-term

Sure, it might take some effort to shift your money, but it’s usually a one-off effort. You don’t want to do much tweaking, since the idea is to allow your assets to build over time. “I can see myself holding and watching this portfolio for quite a while,” says Matthaus of her own SRI investments. “The key to this kind of ‘set it and forget it’ investing is the ‘forget it’ part.”

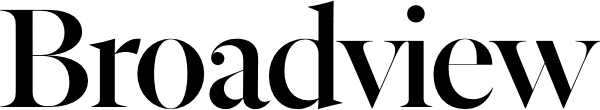

This story was originally featured in Broadview’s October 2019 edition with the title “Good as gold.” To read more of Broadview’s award-winning content, subscribe to the magazine today.

Anyone whom I have hired that makes me look silly, or makes me cry, loses my business – that day.

If people are not involved with their investments, something is wrong, You should have a pretty good knowledge of where your money is going – it’s your money.

A few years back, I had a hard time not making an investment in cannabis. (my SRI) My broker assured me this was the fastest way of making money. It doesn’t seem like it now.

I appreciate the article, but most people don’t care about investing in socially responsible investments. Most want the “biggest bang for the buck”, otherwise the funds mentioned in the above article would be long gone, or made “too good to be true”

It’s a fabulous and complex world! But it’s good to be ethical. I’ve been cautioned by some more expert than myself to avoid any funds that park money in either U.S. or Russian government bills or bonds; they are actively using them for armaments and wars. Switzerland is a good alternative. But currency movements make it challenging. And, Canada’s large banks and brokerages sometimes place investments where we can be uncomfortable. Always learning more!

What a delightfully enlightening article, chockful of good information. A caution from someone out in the trenches (rural!), I am fully aware of the criticism the United Church has borne over its statement on Israel, so I can imagine you might want to just say they are a bad investment, without elaboration. But sadly, there are still so many people who don’t understand that Israel, having been terribly abused by the Nazi’s, is turning around and likewise abusing the Palestinians who are their neighbours, making Palestinian lives so incredibly difficult, and in fact, nurturing hate. I, like many people, do not agree with Israel’s stand on Palestine, and their refusal to change this stance. However, there are many people in the world, like the President of the USA, who are caught in the trap of believing that Israel can do no wrong. That’s ridiculous; no one is perfect, and certainly no country. Because there are people who don’t understand this great truth, I think Israel as a bad investment is a statement that ought not to stand alone.