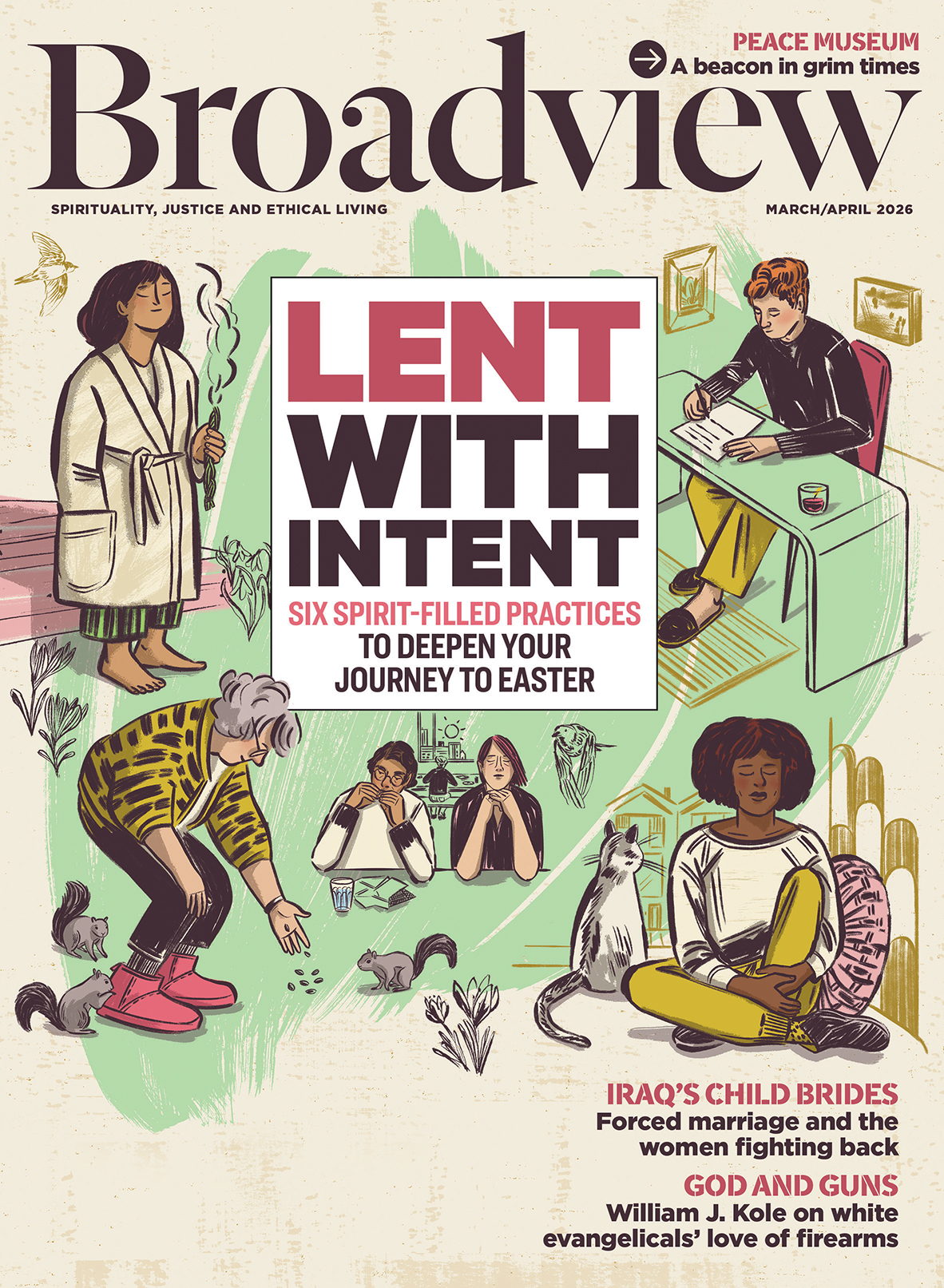

It took the sale of two churches, the co-operation of an existing congregation and Presbytery, plus an unprecedented $3-million bank loan guaranteed by the General Council. But after about four years, the booming Kincora neighbourhood of northwest Calgary has a new $4-million, 316-seat church called Symons Valley United.

New church development takes patience, commitment, vision — and large sums of money. Now, a General Council task group, formed two years ago, has come up with some fresh ideas about how to make that cash available. If adopted, its recommendations could make it easier for new churches to be built — but would radically change what happens when old church buildings and properties are sold.

You may unsubscribe from any of our newsletters at any time.

Among the recommendations: encourage voluntary “tithes” on the sale of under-used properties to help fund new church development; initiate a property inventory that would assess the true value of all church real estate; make loan guarantees — like the one that built Symons Valley United — available across the church.

Task group chair and North Vancouver, B.C., layperson Jeffrey Smith says whenever new ministries are discussed, the church’s real estate wealth is “the elephant in the room.” According to the 2006 Year Book, church replacement value is $3.6 billion and church land is worth $1 billion. The six-person task group calls for “such wealth to be applied . . . to new congregation and ministry development.”

The task group’s report will be reviewed by the church’s committee on Programs for Mission and Ministry this fall, and could eventually go to General Council. For now, the task group wants the discussion out in the open.

As the conversation gets under way, it’s the task group’s proposed method of getting the money out of old buildings and land that may give pause to church members — particularly struggling congregations hoping to cash out on large real estate holdings.

For starters, the report recommends three “tithes” on the sale of church assets. The first 10 percent tithe would go to General Council’s congregational development fund, and be designated to new ministries grants for staffing and startup costs. The second and third tithes would go to the regional Conference and Presbytery for “new ministry initiatives.”

Because only changes to the United Church Manual and perhaps the Basis of Union could make such payments mandatory, the task group calls them “free-will offerings.”

NO ONE KNOWS exactly how much money is realized across the church from real estate sales, but few sales go entirely toward new church development. The United Church of Canada may be the titular owner of all church property, but viable congregations make their own decisions about assets, with Presbytery oversight and approval.

In Burnaby, B.C., Ellesmere United gave close to $300,000 to Westminster Presbytery and a downtown church mission. In Toronto, St. James-Bond United sold its church building for $2.7 million, amalgamated with a neighbour and gave $2.4 million to four social housing projects. In the amalgamation that created Toronto’s Jubilee United, $500,000 went into the Conference’s church development arm, the Toronto United Church Council (TUCC).

Some congregations may balk at handing over money from property sales to General Council and other church courts. In Kitchener, Ont., Highland Road United’s land and building are currently listed for sale at $1.69 million. Diaconal minister Katharine Edmonstone says her parishioners are faithful Mission and Service Fund supporters, but would hesitate to hand money over to an unproven national program. Of the task group’s tithing proposal, she says, “That’s not a tithe, it’s 30 percent.”

One of nine Kitchener congregations working closely together on future plans, Highland Road eventually hopes to use the proceeds from its property for its own new ministry, perhaps in concert with another congregation.

In Toronto, where Deer Park United is selling a downtown property that tax assessors value at $7.7 million, Board chair Fred Graham says money from the sale will help provide “bridge financing” as the congregation decides its future. The congregation may decide to share the proceeds of its property sale, he says, but the beneficiaries will reflect “what the congregation’s spirituality and mission has been about” rather than a formula set by General Council.

The task group’s proposals can also expect a cool reception from Conferences, which currently control properties from defunct congregations and absorb the funds from sold properties. Even if only 10 percent of assets were handed over to General Council, the loss to some Conferences could run into the millions.

“Nobody likes to be taxed,” says B.C. Conference executive secretary Rev. Doug Goodwin. “Nobody likes to see assets leaving their Conference and going into other hands.”

For example, B.C. Conference is considering the sale of a former Vancouver church that’s worth more than $2 million, and it recently sold a camp for $20 million; proceeds from the camp sale will be used by the Conference to pay for upgrades at other camps. Toronto Conference currently controls five former church properties, with two slated for use as Presbytery offices and one for affordable housing. Offers of up to $5 million are being considered for downtown WoodGreen United.

In Toronto Conference, where 70 percent of the money from church property sales already goes to new church development, TUCC executive secretary Rev. Vince Alfano says the task group’s proposed tithes would be a step backward.

In contrast, Toronto Conference executive secretary Rev. David Allen says the task group’s proposals are “not bold enough. Because property is owned on behalf of the whole denomination, why wouldn’t 100 percent of the money go to General Council for property purposes? Then we could move it around where we need it.”

AS THE CHURCH DISCUSSES how funds from those properties should be spent, the task group’s proposed real estate inventory could produce a clearer, but not entirely accurate, tally. Tax assessments reflect a church’s zoning, plus the cost of replacing the buildings. But on the open market, in urban and suburban areas, church properties can be worth anywhere from 30 to 300 percent more than their tax-assessed values.

As for the proposal to guarantee bank loans, says the TUCC’s Alfano, “Anything that uses other people’s money is always well-received.”

The problem with other people’s money is that it has to be paid back. And the recent loan-repayment history of United Church congregations is checkered. Of about $20 million loaned for new church construction under the Ventures in Mission program almost 20 years ago, half is still outstanding. At Westminster United in Whitby, Ont. — where task group member Rev. Christopher White is minister — the congregation has repaid little of $2 million it borrowed, including a $1.26-million bank loan, to help construct a new building five years ago. But if the United Church wants to build churches where there’s a need for them, going into debt may be the only way.

ONE THING IS CERTAIN: the future is sure to bring many more surplus church properties. B.C. Conference is hiring a part-time property development specialist and Toronto Conference relies on an advisory committee — made up of a lawyer, architect and real estate agent — for help with property use and disposal.

In Calgary, Symons Valley United’s land is now worth about three times its purchase price four years ago. And its new building was designed with rental space that should bring in about $60,000 a year. Still, interest charges are steep ($22,000 a month) and the church may have to use borrowed money to make ends meet until the congregation becomes self-sustaining. Attendance is already up to 150 families and expected to top 250 within two years. Numbers, however, are only part of the equation.

“It’s all based in faith,” says the congregation’s minister, Rev. David Drake. “The reality is that if you want to have a church presence, you have to think outside the box.”

***

This story first appeared in The United Church Observer’s June 2008 issue with the title “Real estate reality check.”