Last month, a federal finance committee recommended removing religion as a charitable purpose in Canada. While this idea has been raised before, it’s the first time it has appeared in an official government recommendation. If passed, this could challenge the foundation of how religious organizations—which are affiliated with approximately 40 percent of Canadian charities—operate in Canada.

We asked for your thoughts on the committee’s recommendation. Here’s what you had to say.

You may unsubscribe from any of our newsletters at any time.

These opinions are those of our readers and not necessarily shared by Broadview. The responses have also been lightly edited for clarity.

“I appreciate the issue that the BC Humanist organization raised and wish that more Canadians were aware of it. There are a lot of assumptions behind allowing so many religious organizations to claim charitable status — especially when compared to the challenges other charities face to maintain their status. It’s time for all religious organizations to prove why they should maintain status as a charity: What charitable work are they actively engaged in? Who benefits, and how? How much of the funds they raise are actually invested in the local community? We know that some religious groups funnel donations abroad or follow a prosperity gospel model, where funds disappear into bureaucratic structures. In effect, the federal government is subsidizing these activities.

Religious organizations engaged in genuine outreach should be able to prove it. Moreover, they should be as committed to justice as they are to charity — and able to demonstrate this. Charity often privileges the giver rather than the recipient, providing only short-term relief. While immediate aid is important, it must go hand in hand with efforts to address deeper systemic issues.”

—Michael Saver, Toronto

“I believe many of these organizations contribute to the public good and complement the work of government agencies. For this reason, there should be some provision for extending charitable status to such activities. This may require a more nuanced set of criteria for granting that status, but that would be far preferable to the blunt approach of denying it solely based on religious affiliation.

A more thoughtful framework could enhance the credibility of public policy on charitable status for religious organizations. At the same time, it could encourage these organizations to reflect on their missions, activities and overall impact on the public good.”

—Paul Druber, Ottawa

“The Federal House of Commons Finance Committee’s move to revoke the right of religious communities to issue charitable tax receipts is unsurprising, but it is poorly motivated and out of touch with the realities of faith communities and their members.

Many of these communities serve the common good — especially those who are poor, marginalized or otherwise wronged — far beyond a simple hour of worship. While their ability to engage in political advocacy is restricted, even this limited capacity to push for meaningful changes in discriminatory policies and extreme inequalities remains essential to the public good.”

—Barry K Morris, Vancouver

“My life is richer, I am a better person, and my community is a kinder place to live thanks, in part, to my church. It’s where I am inspired to do charitable work alongside like-minded individuals, where we support one another through life’s struggles, and where I am challenged to see the lives of others in ways that make me more open-minded and generous. It’s also where we raise money for justice — both locally and globally — and partner with organizations to support students, seniors, unhoused people, 2SLGBTQ+ groups and many others in need. Beyond that, churches often serve as hubs for community outreach, offering space to groups that would otherwise struggle to carry out their work.

We are constantly striving to do more with less, using money as a tool rather than an end in itself. If a church is not engaged in this kind of community-building and is simply sitting on a large surplus, I have no issue with it losing charitable status. But no socially minded church I have ever attended falls into that category.”

—Susan Finlay, Sudbury, Ont.

“The recommendation to remove churches from the national list of registered charities is ill-conceived and poses a serious threat to all faith-based organizations that provide vital support services to millions of Canadians. These organizations rely not only on churches themselves but also on the generosity of church members. For many of these members, financially supporting their place of worship is a higher priority than donating to other registered charities. If places of worship lose their charitable status, the ripple effect will mean less funding available for the many charities they help sustain.”

—Harold Quinn, Guelph, Ont.

“Some might assume that those who donate to their place of worship do so mainly for the tax deduction and would simply redirect their giving to healthcare, education and food banks. But that’s unlikely. These are the same generous individuals who will now have to contribute more just to keep the lights on in their synagogues and churches — places that provide counselling, food cupboards, AA meetings, Brownies and Scouts programs, local theatre, and many daycare services.

Stripping religious organizations of charitable status won’t necessarily free up money for other causes. More likely, it will lead to religious donors giving less to external charities. Meanwhile, faith-affiliated hospitals, inner-city service agencies and other organizations may be forced to ‘divorce’ their religious identity through rebranding — potentially alienating volunteers who feel their belief system is being erased.

If I were the finance minister, I would need extensive data to ensure that re-defining ‘charitable’ actually saves more in tax refunds than it costs in nonprofit sector disruption. Government services are already stretched thin, struggling to meet basic mandates in healthcare, education and social support. If we strangle food banks and soup kitchens, where does that leave us?”

—Ann McRae, Dundas, Ont.

“Yes, many churches provide vital community services and should be recognized as charities. However, others focus solely on the spiritual needs of their own members without engaging in broader community work. These churches function more like private clubs and should not receive charitable status.

Simply removing charity status from churches would be a mistake, but I do think the current policy is outdated.”

—Jan Goss, Kelowna, B.C.

“Relax — the report will not be enacted. The number of people engaged in ‘religious’ activities is too significant for any government to risk removing ‘religion’ as a charitable category. Political reality simply won’t allow it. But that doesn’t mean the United Church of Canada (UCC) or Canadians are in the clear.

The real issue is the outdated understanding of religion, humanism, faith and secularism that underpins the report. These definitions no longer reflect the full scope of human religious experience. Wilfred Cantwell Smith — one of our own — argued persuasively that these common understandings fail to capture the complexity of religious expression.

The UCC should not be in the business of defending definitions of religion or secularism that have long passed their best before dates. Instead, we must recognize the need to move beyond the inherited frameworks of ‘modern’ religion. This will be the defining work of the 21st century.”

—Ruben Nelson, Lac Des Arcs, Alta.

“I am a monthly donor to my local United Church, but when deciding where my charitable dollars will have the greatest impact, the church often falls lower on the list. It competes with the food bank, a housing group for battered women, a teen drop-in center, and efforts to build our local hospital and hospice. Simply keeping the church doors open isn’t enough.

Annual stewardship drives often leave me uninspired, and requests from the larger Church rarely resonate with my needs or concerns. If my contributions were no longer tax-deductible, I would likely reduce my support for my local church and redirect those funds to causes where I felt they would do more good.”

—Ken Pettigrew, Grimsby, Ont.

“I completely agree that churches are much more than places of worship. Here in Orillia, our United Church serves as a weekly concert venue, provides space for several charitable groups, and hosts classes for Lakehead University. It’s also home to a local music school, yoga classes and more. Outside major cities, there simply aren’t many venues for these kinds of community programs, and places of worship often fill that gap.

If the government removes religion as a charitable purpose, then by the same logic, it should also withdraw all public funding for elementary and secondary religious schools across Canada. No more separate or Catholic school boards — just one publicly funded system to “reflect Canada’s growing diversity and secularism.” This would improve efficiency and save taxpayer money. Religious education could still be offered as an optional program, but all students would receive the same core education.”

—Anne Kallin, Orillia, Ont.

“Our church hosts two community dinners each a week, two Girl Guide groups, a Scout group and many other community groups. If we lost the ability to issue tax receipts, it would likely result in a significant drop in donations, and I seriously doubt we would be able to survive. What we need is more government support, not less.”

—Brad McMurray, London, Ont.

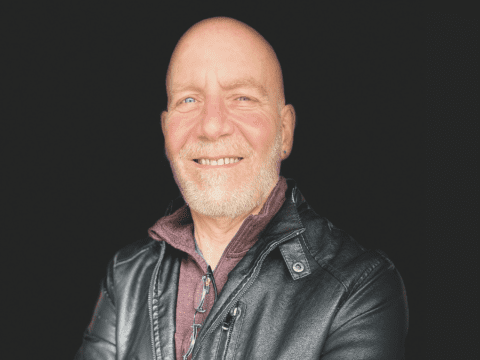

“I recognize that I’m coming at this from a biased perspective, as I’m a retired UCC minister. However, I would like to propose that charitable donation recognition go beyond just monetary contributions. Religious organizations survive largely because of volunteer efforts, which include, but are not limited to, running food banks, supporting the homeless, assisting those marginalized by income, mental health issues, or gender biases, and providing safe spaces for gatherings. The list is enormous.

Personally, I believe the government should create guidelines for people providing these services on a volunteer basis, offering them a tax credit they can claim on their income tax returns. If the government had to step in and take over much of this volunteer work, the financial burden would be immense. Instead of cutting off the benefits of financial contributions, we should be advocating for more support for volunteers in these organizations. It’s time we include both time and talent alongside monetary giving.”

—Rev. Mary-Margaret Boone, Janetville, Ont.

“I think it is ridiculous that the federal government would even consider attacking the charitable status of religious organizations before ensuring that the wealthy people and corporations pay their fair share of taxes — especially since there is abundant research that demonstrates the social benefit of these organizations.”

—Rev. Alison Miculan, Niagara, Ont.

“Religious charities should be tax-exempt and receive charitable donation status because they perform a significant amount of work that the government would otherwise have to take on. If religious individuals and organizations didn’t care for and help others, the burden would fall on public services. The motivation behind the work shouldn’t matter — what truly matters is the impact these charities have in supporting those in need.”

—Lorna Berlinguette, Edmonton

“The long-standing regulations could be seen as outdated and no longer relevant in the context of modern income tax law. However, the significant risk is that it may antagonize many religious organizations, potentially leading them to scale back or even abandon their valued and important outreach programs in the communities they serve.

On the other hand, this shift in federal regulations might not be entirely negative. Many religious and faith-based organizations don’t engage in outreach services because they don’t see it as a central part of their mission. This change could pressure them to place greater emphasis on outreach as a core aspect of their work. This could be an important development and, rather than being opposed, it could be embraced as an opportunity for growth and reflection.”

—Rev. S. Dale Perkins, Victoria, B.C.

Michael Saver, Toronto commented : “Religious organizations engaged in genuine outreach should be able to prove it.” We do have to prove it. As treasurer of a small Ontario church I have to fill in an extensive yearly financial report to the CRA Charities Directorate to maintain our charitable status. We have zero administration expenses.

THANK U ….IF PASSED WHEN WOULD THIS CHANGE TAKE EFFECT? IN 2027?